India’s electric vehicle (EV) market is in overdrive. Valued at USD 2.48 billion in 2023, it is projected to hit USD 113.99 billion by 2029, according to industry estimates. Policy nudges, corporate investments, and consumer interest are aligning to make cleaner mobility a mainstream option.

But behind the optimism lies a less visible question: can the country’s power grid handle the rapid shift, especially with the rising appetite for fast charging? Encouragingly, the numbers suggest the challenge is less about total demand and more about planning the grid of the future.

Fast Charging Feeds Convenience and a Potential Power Crunch

Fast-charging infrastructure is the EV industry’s ace in the hole. Delivering an 80% charge in under 30 minutes makes electric mobility feel as seamless as refuelling a petrol car. Yet, every high-power DC charger draws between 50 and 250 kilowatts, but in the bigger picture, this is well within what the grid can handle when demand is spread out.

Where multiple chargers are clustered, demand spikes can occur, yet this is not a crisis in waiting. With smarter load management and ongoing network upgrades, these local peaks can be absorbed without disrupting supply.

Even Tier-1 Cities Still See Power Interruptions

India’s power sector has made significant strides in increasing its generation capacity, but the distribution network, which delivers electricity to homes and businesses, remains vulnerable. Voltage fluctuations, transformer overloads, and unscheduled outages are not uncommon, even in major cities like Mumbai, Bengaluru, or Delhi.

These are the same urban hubs that are now emerging as early adopters of EVs. If the grid is already under strain during peak hours, introducing thousands of high-demand charging points could exacerbate the problem.

But how much electricity do EVs actually use?

Energy demand projections often portray EV adoption as a looming crisis, but the actual numbers suggest otherwise.

Fast-charging infrastructure currently accounts for ~7.4 GWh of consumption from around 20% of the CCS2 chargers in use. If the rest of the chargers performed similarly, total consumption would scale to ~37 GWh.

This, however, is a generous assumption, because a large proportion of fast chargers set up by public sector entities, such as BPCL (60%+ non-functional), HPCL (40%+), and IOCL (95%+), remain offline, despite being among the largest charging providers in India.

Even so, if 37 GWh is taken as a baseline, it only reflects around 20% of EV-specific charging. Extrapolating this to 100% yields ~185 GWh for two months (April–May). For the full year, that translates to roughly 1.1 TWh.

Placed against India’s total electricity demand of over 1,400 TWh, this is a rounding error, less than 0.1%. So, if the math clearly shows that EVs add no more stress than seasonal increases in cooling demand or new industrial loads, then how did the narrative of a strained grid even arise?

The real bottleneck lies not in demand itself but in grid inefficiencies, uneven load distribution, poor feeder-level planning, and weak renewable integration. With more innovative demand management and deeper penetration of solar and wind, EV charging could actually help balance the grid instead of burdening it.

Renewable Energy Could Become the Balancing Force

There is a path forward, and it runs through clean generation. India’s renewable energy capacity has surpassed 180 gigawatts, creating an opportunity to directly pair EV demand with green supply. Solar energy aligns with daytime charging patterns, while wind energy can complement overnight charging.

Some states have piloted solar-powered charging stations, reducing strain on the primary grid. The challenge lies in scaling these pilots into nationwide, integrated solutions, ensuring they are both commercially viable and technically reliable.

The EV Transition Depends on Grid Modernisation

The EV ecosystem rests on three interconnected pillars: vehicle adoption, charging infrastructure, and grid readiness. If one falters, the transition slows. Selling more EVs is not enough; distribution transformers must be upgraded, substations must be able to handle higher loads, and grid management systems must adapt to variable charging patterns.

India has demonstrated the ability to leapfrog in sectors such as telecom and digital payments. But in energy, the leap must be calculated, ensuring that technological ambition aligns with operational capacity.

This has been done by taking lessons from global markets

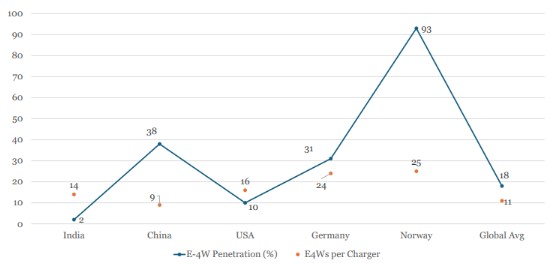

China’s EV boom offers both inspiration and caution. Its rapid scale-up was supported by massive public investment in charging infrastructure and a robust manufacturing ecosystem. However, despite its industrial might, China has faced regional grid pressures, prompting targeted upgrades and the integration of renewable energy sources.

European nations, such as Norway and the Netherlands, demonstrate the importance of pairing EV incentives with renewable energy expansion and grid modernisation. Without those elements, adoption can stall or backfire.

Charging infrastructure availability Vs 4W EV penetration (2024)Charging infrastructure availability Vs 4W EV penetration (2024)

The road ahead for India’s EV-grid balance

The coming decade will test India’s ability to synchronise transport electrification with power sector reforms. EV adoption is inevitable, driven by falling battery costs, consumer preference, and environmental urgency. However, without grid readiness, backed by renewable energy growth, battery storage, and smart load management, the transition risks being bumpy.

A collaborative approach between policymakers, utilities, and private innovators will be critical. The good news? India’s EV shift is still in its early innings, meaning there’s time to design the grid of the future before demand truly peaks.

FAQs

Q1: How much extra electricity would India’s grid need if 30% of private cars become electric?

A1: If 30% of India’s private cars, about 12 million, switch to EVs, the grid could need an additional 65,700 GWh annually, roughly 7–8% of current consumption.

Q2: Why could fast chargers pose a risk to the power grid?

A2: High-power DC fast chargers (50–250 kW) used simultaneously in hotspots can create demand spikes that strain local distribution networks without grid upgrades.Q3: Can pairing EV charging with renewables ease grid stress?

A3: Yes, such as solar-driven daytime chargers or wind-oriented charging at night, you can align EV use with green power and buffer peak load.